Recently, I have been working alongside students from across the Denver area to create a state-wide student union called the Colorado Student Power Alliance, which works on cross campus campaigns to improve higher education in our state. Most recently we have been focusing on the issue of student debt.

One year ago, national student debt passed 1 trillion dollars. And while my generation is feeling that burden, I, myself, have a binder filled with 4 years of private and public loans from 4 years of undergraduate, at a fabulous, yet nauseatingly expensive, private college. I am not alone. 2/3 of students graduating university are leaving with student debt, the average amount owed is above $25,000. And while many are quick to assert that being in student debt is my fault, blaming the individual simply ignores that higher education has become a way of reinforcing class divides by inhibiting working and middle class from earning degrees without putting themselves at the mercy of large corporations who own the debt that it is becoming virtually impossible for us to pay off. Many students graduating are either under employed or unemployed after graduation illustrating that our degrees are not worth the amounts we are being charged.

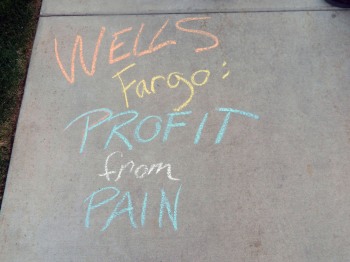

After 9 hours in a Van with other members of the Colorado Student Power Alliance, we arrived in Salt Lake City, Utah to protest at the Wells Fargo Shareholder meeting. We joined members of the Alliance of Californians for Community Empowerment (ACCE) who, through their fight against home foreclosures in California, had sent Wells Fargo on the run. Past protests had convinced John Stumpf to break a 16 year tradition and move the meeting from San Francisco to Salt Lake City. So, while ACCE pursued the fleeing stage-coach and horse from the west, we flanked from the east. We were there to make sure that unlike any scene from the Music Man, The Wells Fargo Wagon arrived in its destination, not to the joy of the town, but to vivid reminders of its violent foreclosure and debt policies.

After 9 hours in a Van with other members of the Colorado Student Power Alliance, we arrived in Salt Lake City, Utah to protest at the Wells Fargo Shareholder meeting. We joined members of the Alliance of Californians for Community Empowerment (ACCE) who, through their fight against home foreclosures in California, had sent Wells Fargo on the run. Past protests had convinced John Stumpf to break a 16 year tradition and move the meeting from San Francisco to Salt Lake City. So, while ACCE pursued the fleeing stage-coach and horse from the west, we flanked from the east. We were there to make sure that unlike any scene from the Music Man, The Wells Fargo Wagon arrived in its destination, not to the joy of the town, but to vivid reminders of its violent foreclosure and debt policies.

Four of us dressed in business attire with proxies in hand walked toward the Grand America Hotel. We were going inside. It didn’t feel like only four of us were going in to that meeting. In efforts to calm my nerves, I thought back to each student who had shared their debt story with me. Those who had written their five and often six figure debt numbers on our debt wall. I recalled the graduates who feared garnishments and unemployment and getting up to 7 calls a day from collectors. I also recalled the 50 letters that student groups around the nation were delivering to Wells Fargo branches in their communities, and I thought of the Macalester students, who within the same hours were beginning a sit-in in their administration building to force their President to kick Wells Fargo off their campus. We were only four, but we were there to speak as part of a generation of youth enslaved by unbearable debt. A generation that is mobilizing in our communities and on our campuses to fight back.

As the second largest private profiteer from student debt, the key to the debt shackles on thousands of my peers was possessed by the multimillionaire corporate banker who stood behind the podium in the front of the shareholder meeting.

During the meeting, after hearing close to a dozen concerned shareholders bring critiques of racial discrimination, unjust housing foreclosures, and John Stumpfs obscene salary- all of which were quickly dismissed by an unphased Stumpf who cast off the concerns with rhetorically empty sound bites of corporate policy- we began our action.

When the first member of ACCE stood up, John Stumpf tried to quiet her down. There would be a question and answer period later, he insisted. During the previous comment period John Stumpf had ignored all the hands raised by women and people of color in the room and had only called on white men. He had, additionally, cut off the comment period at only four people. We knew that voicing our concerns in a forum provided by Stumpf himself was neither optimal nor possible. We were done raising our hands to be heard. We would not ask his permission to resist. One after another we began standing up to John Stumpf and demanded that he hear our concerns. After two women went, it was my turn.

“You are stealing our future!” I did yell at the highest paid banker in the nation. I was surprised, myself, by the power in my voice. John Stumpf’s head jolted away from the person who spoke previously and shot in my direction. For about the next 15 seconds the floor was mine. I told John Stumpf that Wells Fargo was participating in the destruction of higher education, condemning our generation to a lifetime of debt, and that we demand a process for loan modification. As I was escorted out of the room, I heard a fellow COSPA member’s voice ring out continuing our message to Stumpf, who had temporarily given up trying to silence the voices he ignores on a daily bases. He was silent now. For the time being, he had lost control of the meeting.

Moments after I was led out the doors, members of our team still in the meeting began chanting “Racist Lending is a crime, John Stumpf should be doing time!” They, too, were escorted out, and we were all reunited by the security guards who were anxious to get us all the way out of the building. We complied and headed slowly to the doors but continued our chant. The words echoed off of the marble walls, crystal chandeliers, and back into the shareholder meeting, where an exposed John Stumpf was trying to regain control of the meeting.

Once outside, we joined the people out front protesting. We continued to march to three different Wells Fargo locations to deliver letters that outlined demands from our groups.

Once outside, we joined the people out front protesting. We continued to march to three different Wells Fargo locations to deliver letters that outlined demands from our groups.

The opportunity to see a corporate giant shake- be it by silencing John Stumpf at his own shareholder meeting or the dropping of shutters and locking of doors as a march arrives at another bank branch- is a direct reminder of the power we have. Wells Fargo knows that they cannot hide. That they cannot run. And that, while they can escort us out of meetings, they cannot stop a student movement set to expose and end their violent lending practices.

it’s a myth that college graduates have more debt than they used to. In fact, they have less. Total debt for 20-somethings has fallen since its peak in 2008, as it has for every age group in this period of deleveraging. Families that feasted on credit in the last decade have spent the last few years paying back what they owe and cutting back their excessive spending. Young people, with and without student loans, have done the very same.

Average debt among twentysomethings is at its lowest since 1995, according to a recent Pew Research Center report. More than a fifth of young households in 2010 didn’t have any debt at all — the lowest in 30 years.

http://www.theatlantic.com/business/archive/2013/04/are-student-loans-destroying-the-economy/275083/